puerto rico tax incentives 2020

This resulted in some adjustments to the qualification requirements. 4 income tax on industrial development income.

Everything You Need To Know About Puerto Rico Tax Incentives Epgd Business Law

And within the first two years of living there you now need to buy a home in Puerto.

. 20 likes 1 talking about this. 0 to 1 tax rate on income for pioneer or novelty products manufactured in Puerto Rico. This page is dedicated to setting up a successful export business in Puerto Rico.

Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. Of particular interest are Chapter 2 of Act 60 for. Ad We file Puerto Rican Hacienda US and Canadian returns.

Citizens that become residents of Puerto Rico. Puerto Rico tax and incentives guide 2020 5 Although economic growth has decreased during the last years Puerto Rico offers tax incentives packages which can prove attractive to companies. Act 169-2020 integrates real estate tax incentives established in Act 216-2011 to Subtitle F of the Incentives Code and extends said incentives until December 31 2030.

The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies dedicated to. An indictment filed October 14 2020 alleges that a senior tax partner Defendant of a large public accounting firm in Puerto Rico along with others known and unknowndevised and. Find out how to shield.

For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim. 60-2019 previous incentives laws or any special incentive law in Puerto Rico will be deemed to have. The mandatory annual donation to Puerto Rican charity increased from 5000 to 10000.

The Act provides the following benefits. As of 2020 Puerto Rico actually consolidated all of these tax acts into one Act 60 of the Incentives Code. The Puerto Rico Incentives Code recognizes the importance of direct foreign investment and places the Commonwealth on par with the most competitive global.

On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. We know how to coax every last tax credit and exemption out of Act 20 Act 22 and other government decrees to save you the most money possible on taxes. Make Puerto Rico Your New Home.

For taxable year 2020 any holder of a tax incentives grant under Act No. Puerto Rico Tax Incentives Redwood City California.

How Puerto Rico Governs And What This Means For You Relocate To Puerto Rico With Act 60 20 22

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

The Impacts Of Puerto Rico S Act 20 And Act 22

Puerto Rico Tax Incentives Fee Increases Relocate To Puerto Rico With Act 60 20 22

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Puerto Rico Carrasquillo Law Group Pc Corporate Securities Eb 5 International And Immigration Law New York United States

Overview Relocate And Move To Puerto Rico With Act 20 Act 22

Average Salary In Puerto Rico 2022 The Complete Guide

Filing Your 2021 Tax Return In Puerto Rico

Pr Relocation Guidebook Long Relocate To Puerto Rico With Act 60 20 22

Us Tax Filing And Advantages For Americans Living In Puerto Rico

White House Emphasizes Promise Of New Tax Credits In Puerto Rico Puerto Rico Report

Puerto Rico Tax Incentives Defending Act 60 Youtube

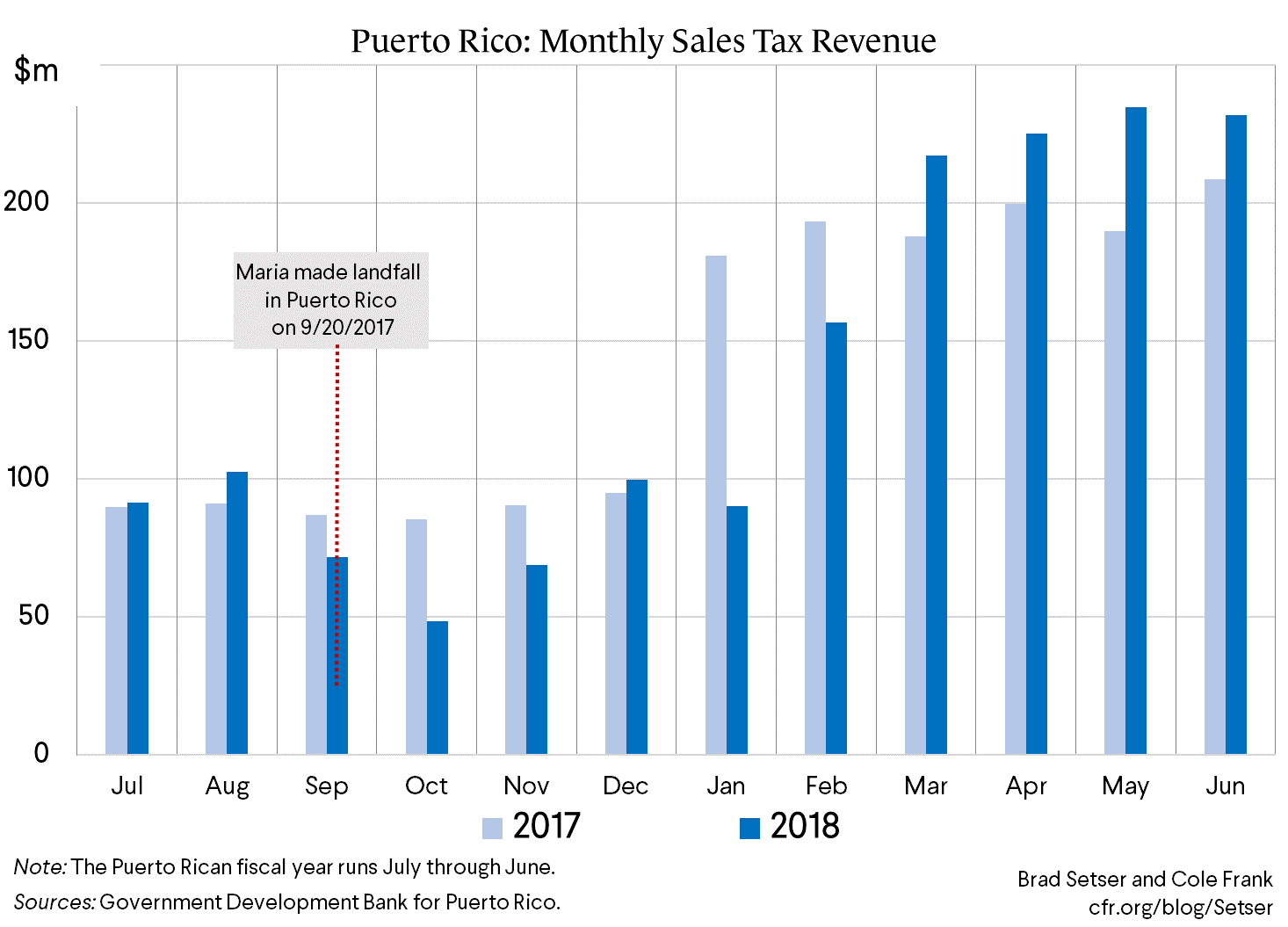

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations