us germany tax treaty protocol

The Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. Under the US-German estate tax treaty interspousal transfers are excluded from a qualifying decedents gross estate for US.

In accordance with the provisions and subject to the limitations of the law of the United States as it may be amended from time to time without changing the general principle hereof the United States shall allow to a resident or citizen of the United States as a credit against the United States tax on income.

. The main changes that the Protocol makes to the Cyprus-Germany income tax treaty 2011 are the introduction of the BEPS minimum standards and amendments to Article 7 Business Profits in line with the OECD Model Tax Convention 2017. Protocol between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes signed at bonn on august 29 1989 general effective date under article 32. Respect to Taxes on Income and Capital and to Certain Other Taxes.

Estate tax purposes to the extent that their value does not exceed 50 percent of the value of all property included in the US. Most importantly for German investors in the United States the Protocol would eliminate the withholding. The German Protocol entered into force on 8 December 2021 and has an effective date of 1 January 2022.

International tax compliance further building on that relationship Whereas Article 26 of the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income and Capital and to Certain Other Taxes signed at Bonn on August 29 1989 as. Strong measures to prevent treaty shopping The United States branch tax prohibited under the existing convention will be imposed on United States branches of German corporations for taxable years beginning on or after January 1 1991. If both countries ratify the Protocol it will be effective as of January 1 of the year in which the two countries exchange instruments of.

Estate and Gift Tax. Signed on 29thAugust 1989. The proposed anti-abuse provision is uniquely tailored to.

DEPARTMENT OF THE TREASURY THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION SIGNED ON 29TH AUGUST 1989. The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts as amended by the Protocol to the German American Treaty generally referred to as the Germany-US. Each country protocol deals with amendments to a few or several articles within the tax treaty however all include an amendment to the article related to the Exchange of Information between the US tax authorities and other countries which has been the major reason for holding up the protocols.

DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE PROTOCOL SIGNED AT BERLIN ON JUNE 1 2006 AMENDING THE CONVENTION BETWEEN. The United States of America and Canada hereinafter referred to as the Contracting States DESIRING to conclude a Protocol amending the Convention between the United States of America and Canada with Respect to Taxes on Income and on Capital done at Washington on 26 September 1980 as amended by the Protocols done on 14 June 1983 28. Germany - Tax Treaty Documents.

Technical explanation of the Protocol signed at Berlin on June 1 2006 the Protocol amending the Convention between the United States of America and the Federal Republic of Germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes and the related protocol. This is demonstrated by the US-German estate tax treaty. Please note that treaty documents are posted on this site upon signature and prior to ratification and entry into force.

- 2 - The United States of America and the Federal Republic of. PROTOCOL AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION WITH RESPECT TO TAXES ON ESTATES INHERITANCES AND GIFTS SIGNED AT BONN ON DECEMBER 3 1980. The Protocol modifies the preamble of the treaty to specify that its purpose is to prevent double taxation without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance including treaty-shopping arrangements for the indirect benefit of residents of non-contracting states.

The United States of America and the Federal Republic of Germany desiring to amend the Convention Between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income and Capital and to Certain Other Taxes and the related Protocol signed at Bonn on. In the table below you can access the text of many US income tax treaties protocols notes and the accompanying Treasury Department tax treaty technical explanations as they become publicly available. Protocol to the GermanyUS Double Tax Treaty On June 1 2006 Germany and the United States Contracting States signed a Protocol Protocol to amend the 1989 Germany-US income tax treaty Treaty.

Tax treaty approach with certain modifications addressing fiscally transparent entities formed or organized in states with which the source state does not have an agreement containing a provision for the exchange of. This is a technical explanation of the Protocol signed at Washington on December 14 1998 the Protocol which amends the Convention Between the United States Of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts signed at Bonn on December 3 1980 the. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

Protocol Amending the US-French Income Tax Treaty signed December 8 2004 Protocol Amending the Convention between the Government of The United States of America and the Government of The French Republic for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income and Capital. Estate and Gift Tax Treaty. The guidance is contained in IRS Announcement 2008-39.

The US Internal Revenue Service IRS has published guidance regarding the mandatory arbitration procedure contained in the 2006 protocol to the UnitedStates-Germany tax treaty that entered into force on 28 December 2007. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

The 2006 protocol modified certain provisions of the tax treaty. The United States of America and the Federal Republic of Germany on the occasion of the signing on 1 June 2006 of the Protocol Amending the Convention Between the United States of. The complete texts of the following tax treaty documents are available in Adobe PDF format.

A the income tax paid or accrued to the Federal Republic of Germany by or on. Protocol and to adopt the modern US.

What Is The U S Germany Income Tax Treaty Becker International Law

Minister Gramegna And Ambassador Evans Bring Us Luxembourg Taxation Protocol Into Force U S Embassy In Luxembourg

Ukraine Ratification Of The Protocol To The Tax Treaty With Austria

Tax Treaties International Scenario And India Relevance Amarpal S Ppt Download

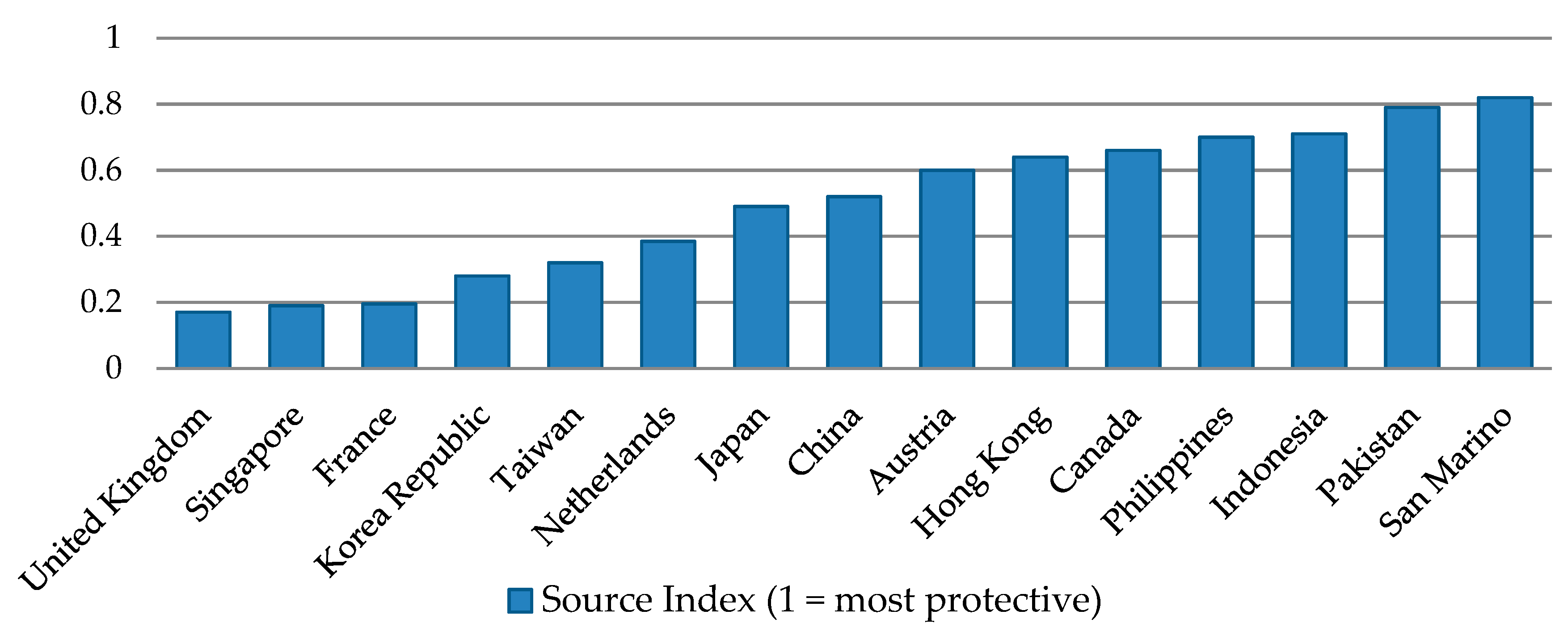

All Rights Reserved Review Of Tax Treaty Policy 1 A Review Of Indian Tax Treaty Policy Comparing Indian Tax Treaties With Oecd And Un Models January Ppt Download

Bulgaria Tax Treaty International Tax Treaty Freeman Law

Spain Protocol Of The Spain Us Tax Treaty Enters Into Force International Tax Review

Spain Protocol Of The Spain Us Tax Treaty Enters Into Force International Tax Review

Tax Alert Protocol Amending The Polish Dutch Dtt Ratif Kpmg Poland

The Tax Treaty Protocol Signed Between Spain And The United States Rsm Spain

Minister Gramegna And Ambassador Evans Bring Us Luxembourg Taxation Protocol Into Force U S Embassy In Luxembourg

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html